Owner-operator average income, according to business services firm ATBS, has topped $70K annualized, based on earnings analyzed at mid-year 2021 and reaching back to the final six months of 2020. $70K also happens to be a figure ATBS President Todd Amen and other ATBS reps routinely cite as a point at which an individual owner-operator is likely to be able to justify the cost of filing as an S Corporation – a so-called "passthrough" method of business tax filing. Business income in such a structure still flows through the owner's personal tax return.

"We've set up a lot of S Corps this year," said Todd Amen, speaking during Overdrive's October 21, 2021, Partners in Business live webcast charting owner-operator income performance through 2021.

Side benefits of the S Corp structure include that its necessary treatment of an owner-operator's annual salary as a business expense allows for better analysis of true business profit separate from personal income. That's among the practices that Amen sees as hallmarks of high earners among ATBS' one-truck clientele. "When we talk about the top 10%" of high earners and how they separate themselves from others, "this is what they do," he said. Amen referenced personal and business budgeting. On the personal side, high performers take the time to figure out what it costs them to live, determine an amount to pay themselves accordingly to cover that cost, then analyze what's left as the business income. "That's a real businessperson paying themselves as an employee and treating it like a true business."

Some owners start doing it just to save on taxes with an S Corp structure, yet "it's a side benefit in that it turns them into a true businessperson," he added.

[Related: Live with ATBS: Strong freight, rates environment expected to last through end of 2022, more]

The S Corp structure allows for the portion of an owner-operator's income not included in the owner's salary to be separated from the liability to pay self-employment tax, delivering tax savings.

For an owner-operator previously banking $80K annually who moves to pay him- or herself a salary of $50K under the S Corp structure, the tax savings on that additional $30K would amount to 15.3% of the figure, or roughly $4,500 for the year. Ongoing costs can be substantial, however, including a ballpark $100/month for a payroll service to manage regularly banked tax withholdings as the owner-op becomes a W2 employee of the business.

Cost/benefit calculations are fairly simple to do. What's more difficult is calculating whether the time is right to make the switch. And once you do – figuring out just what to do with taxes saved to make best use of it without shortchanging future Social Security earnings to the detriment of quality of life in retirement.

One thing's certain, however. If you're going to do it, this part of the year is high time to be starting the process. Paul Hammeke, ATBS rep, along with James Countryman, over ATBS' Enterprise service, walked Overdrive through the process of getting your business set up to file as an S Corp.

Establish Limited Liability Company, get Employer Identification Number.

These first steps in the process may or may not be applicable, depending on whether the business is already set up in your state as an LLC. Fees vary depending on where your business is domiciled, and run through your Secretary of State's office. "It could be as little as $50," or as high as $500 annually, Hammeke said. The firm typically uses a third party (there are many out there) when handling the set-up for clients. Most Secretary of State websites feature modules that guide users through the process.

"When you have an LLC there are annual reports" that businesses have to file, Hammeke added, but generally "it’s not too hard to handle." As with everything in the S Corp set-up process, "you want to make sure what you’re saving in taxes will outweigh the cost of an S Corp," including the set-up and ongoing administrative fees, as the case may be.

Given to file as an S Corp and reap tax savings you will need to treat yourself as a W2 employee of your own business, you'll need an Employer Identification Number assigned to the business by the Internal Revenue Service. There's no fee for obtaining an EIN, though the filing process could take up to a couple weeks before the EIN can be used, according to the IRS.

Here's a link to the IRS EIN application website.

If you already have an EIN – "something I hear a lot," Hammeke said – but are setting up your LLC anew, ATBS recommends clients obtain a new EIN so that it's tied to the LLC. "Switch everything over and run under that [new] EIN number," Hammeke said. "That way you’re getting the most legal protection" of business assets from the LLC structure itself, one of the key features of the business structure "even if you're not going the S Corp route. Establish a business bank account, have that EIN," and separate personal and business assets. "If you get sued and everything's commingled," he added, "it could give someone opportunity to go after your personal assets."

Obtaining the EIN is part of ATBS' process in S Corp set-up with the third party it uses for establishing the LLC. You'll need it for the next step in the process.

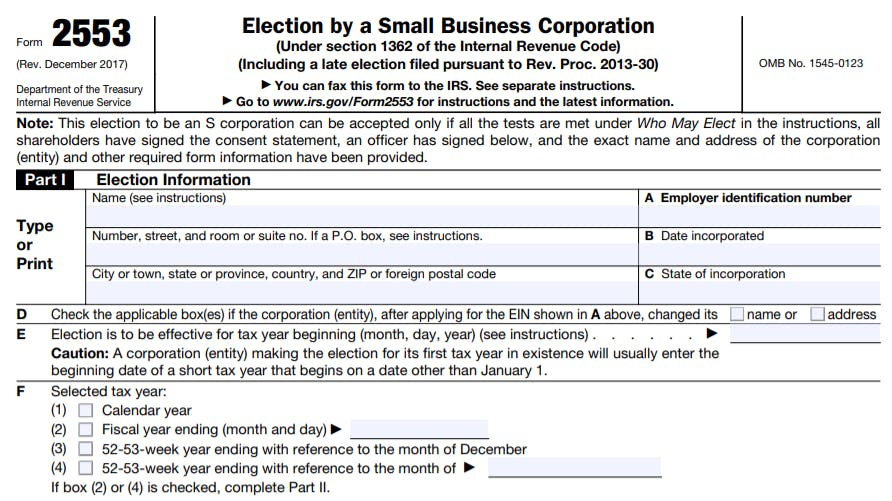

File Form 2553 with the IRS

Form 2553 is the IRS form you use to declare your business an S Corp for tax filing purposes. Find the full form and more information from the IRS via this link.

Form 2553 is the IRS form you use to declare your business an S Corp for tax filing purposes. Find the full form and more information from the IRS via this link.

IRS Form 2553 is filed to declare intent with the IRS for your LLC to be taxed as an S Corp.

"There's not much to it," Hammeke said of the form itself, though ATBS recommends that, if you're going to go the S Corp route, do it to begin the first day of the year (see section E in the partial form snapshot above).

The IRS gives filers until March 15 to get the form in for the full calendar year, he added, but backdating the forms can be problematic unless payroll is well in process.

Keep in mind, too, before you file the 2553: Make sure you're ready. Unlike a C Corporation business structure, an LLC taxed as an S Corp is fairly easy to get out of -- it's a matter of checking a "final return" box on a form. But: "You can’t go back to being an S Corp for five years" if you return to standard self-employed tax treatment, Hammeke said.

Set salary, establish payroll processing with third party

Determining your own salary as an owner-operator is something that more owners have done in recent history, whether they're being taxed as an S Corp or not. Doing so allows that salary for internal accounting purposes to be viewed as an expense, with more refined business profit performance analysis, as suggested above by ATBS President Todd Amen.

For filing as an S Corp, though, a personal salary is a requirement and necessitates getting set up with a payroll processing service provider.

ATBS has a "wholesale account with ADP," a payroll and HR services company, Hammeke said. "We charge $225 for that setup and $80 a month to run the payroll," which will account for ongoing W2 tax deductions. As noted above, Hammeke ballparks costs for those doing it on their own at around $100 a month. Landstar-leased owner-operator Steve Wheeler, as detailed in this story from earlier in the year by Overdrive Extra contributor and owner-op consultant Gary Buchs, noted he was utilizing Paychex, which advertises its lowest-cost service at $39/month in addition to $5 per employee.

Buchs himself said most of the owner-operators he's been working with have been going with Patriot Software's online payroll processing system, with accounts as low as $10/month but generally around $20, Buchs said.

Make sure, Buchs added, you're meeting your state's requirements for payroll employers, which could include provisions related to carrying worker's compensation coverage for any employee (yourself, now) among other stipulations. If not met, such requirements could come with fines. And as with new corporate tax filing requirements (see below), timeliness is extremely important when it comes to payroll. Buchs encourages individual clients who are handling payroll themselves to set alarms on their phones ahead of monthly deadlines to be sure they don't incur fees.

[Related: Building personal payroll -- a step toward tax savings, better finances]

As part of Buchs' story earlier this year, owner-operator Wheeler indicated his business was paying him as an employee $4,500/month plus $1,300 in per-diem reimbursement. After taxes are withheld, the net is $3,574, plus $1,300, or $4,874 in net pay per month. He figured at the time of Buchs' story that he might be paying himself "too much,” he said, yet he's also a significant investor in real estate and needs to show solid W-2 income to qualify for mortgages. His net pay equates to $58,488 in after-tax income (almost $70K before tax, tracking closely to recent owner-operator income averages).

On top of that, the business profits another "$30,000 to $45,000 per year,” he said.

ATBS' rule-of-thumb recommendation for LLCs newly electing to file as S Corps is somewhat more aggressive. "Our baseline recommendation," Hammeke said, noting there's not a direct recommendation anywhere in IRS code, is to "pay out half of the profits as a salary. If you're at the $80K income mark, pay yourself around $40K payroll."

Granted it's "tough to know until the end of the year where you'll land in terms of net income" overall, he said, that roughly-half rule of thumb tends to ensure added costs are well more than covered in tax savings, and allows for adjustments each year as business income improves. A lot, too, "depends on lifestyle," Hammeke said. Reference the personal budgeting Todd Amen stressed at the top. "Do you have an expensive car?" Hammeke added. If so, "pay yourself higher. ... If you’re clearing $120K or $150K, you'll want to pay yourself more, too," crucial for bigger businesses that would justify a larger salary.

Justification is key for salary floors, too: "You have to pay yourself a reasonable salary," Hammeke stressed, something commensurate with driver earnings around other areas of trucking. If you don't, it could trigger an audit.

Hammeke stressed it's hard to get payroll processing up and running right away, ballparking a three-to-six-week period for getting things set up. "You have to get accounts for income tax withholding and unemployment accounts set up with the state," he said, with some exceptions for those that don't have income tax. In addition, "a lot of states won’t let you apply for these accounts before the end of the year." For LLCs newly filing as S Corps with set-up through ATBS, "our goal is to get them up and running in February."

By the end of the year, Hammeke stressed, the IRS will want to see "what you paid yourself as a total salary" as "something that's reasonable" in relation to your business profit.

Ongoing considerations, costs

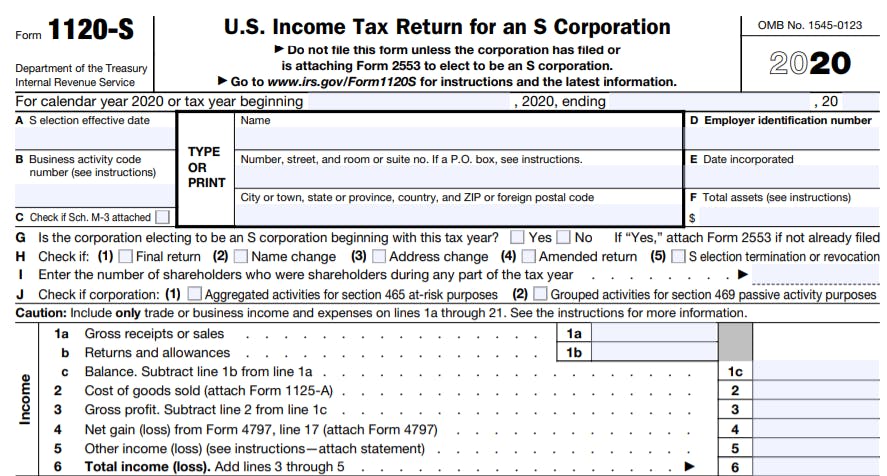

LLCs filing as S Corps will see an overall increase in accounting costs, given two returns – both corporate and personal – will need to be filed annually. Shown here is the new corporate return on Form 1120-S that will be required. Access the full 2021 form when available and generally more information about it via the IRS website.

LLCs filing as S Corps will see an overall increase in accounting costs, given two returns – both corporate and personal – will need to be filed annually. Shown here is the new corporate return on Form 1120-S that will be required. Access the full 2021 form when available and generally more information about it via the IRS website.

Accounting costs: Generally speaking, for LLCs filing as S Corps, these costs will increase. Form 1120-S, a separate return for the business, will be due annually March 15 (September 15 if a timely extension request is filed) and will essentially replace the Schedule C that self-employed businesses typically file a month later with personal income tax returns. Those personal returns will be simplified, to an extent, yet of course still need to be filed.

ATBS charges an extra $750 as part of their filing services for the corporate return, Hammeke said, building that into a monthly fee for clients whose businesses are structured this way. Bottom line: You're "going to pay more for tax services being a corporation," he added.

Hammeke stresses that 1120-S filings don't mean that the business itself owes taxes. The total business income calculated on the 1120-S passes through to the owner's personal return.

Retirement savings: Keep in mind, too, that by avoiding self-employment taxes on the business's income, you're in effect short-changing future Social Security benefits. The owner-operator with a goal of getting set up fully for retirement will consider investing self-employment tax savings in a retirement vehicle such an IRA or 401k. While Hammeke noted he's no "retirement expert," he said the so-called "SEP" Individual Retirement Account investment vehicle is probably "the easiest to account for." Contributions to the "Simplified Employee Pension" IRA come only from the LLC business and can amount to up to 25% of the employee's total salary annually. The higher the salary you set, the more you can potentially contribute in a tax-deferred manner.

Distributions from the business to a personal account: If you aren't coming to the S Corp structure with substantial savings already built up or you have a whole lot of debt, the move may not be right for you, said Hammeke. Part of the reason is there will come a time when you need to pull money from the business to utilize in your personal life. While that's generally kosher, if you're writing distribution checks from the business that exceed your "basis" in the business, you can be hit with capital gains tax on some of those distributions.

An excessive amount of debt can "throw off the balance sheet from the get-go," Hammeke said. Rules around assets basis in the business could mean that distributions to personal taxes trigger those capital gains taxes. An experienced accountant should be able to advise you on whether you're in a decent-enough financial position to make the switch.

Distributions' amounts, generally speaking, too, need to be reasonably balanced with your salary as an employee. An audit "red flag" for the IRS, Hammeke said, might be the situation of an owner who only pays himself $40K annually in salary but has "taken out $100K in personal distributions. ... I typically say you want to have an even balance between what you pay yourself and what you take out as a distribution" in any given year. "You don't want to get greedy with it."

[Related: Annual/midyear reset: Get off the treadmill, consider costs, balance sheet]

When business balance sheets are required: This is a big difference for Schedule C filers and S Corps – for the latter, once gross hits $250K, there is a requirement for the business return to include a balance sheet, noting business "account balances as of December 31" in the filing year, Hammeke said – "bank and credit card balances, assets and depreciation, retained earnings. ... Those are the big ones."

Hammeke said he had a fair amount of solo owner-operators grossing over that amount. "If you're doing under $200K gross," he said, "you really have to have minimal expenses to be clearing that $70K net income mark" where the S Corp structure begins to make sense for an owner-operator, he said.

Moving ahead with an S Corp structure in place, he added, it's "very important to stay organized – once you file your corporate return late, they start dinging you with penalties for that." The due date is before the April 15 personal deadline, as noted above, and too many owner-operators forget that fact. If they don't file or request an extension, the penalty can add up quick – "$200 per shareholder per month," Hammeke said, or typically $2,400 for a year for an owner-operator business. "It's definitely important to be organized and on top of any accounting service you're using."

Freight/carrier contracts: After making the switch, it's important to recognize that payments you're receiving either from the carrier you're leased to or from brokers you're contracting with, said Buchs, are tied no longer to your personal Social Security number or old EIN number for the business but to the EIN associated with the new LLC/S Corp. That may necessitate brand-new lease/broker contracts or simple contract revisions, depending on the entity.

Find more information about taxes and business structures, among a myriad other topics, in the Overdrive/ATBS-coproduced "Partners in Business" manual for new and established owner-operators, a comprehensive guide to running a small trucking business. Click here to download the 2021 edition of the Partners in Business manual free of charge.

from Overdrive https://ift.tt/3D62Hqh

Sourced by Quik DMV - CADMV fleet registration services. Renew your registration online in only 10 minutes. No DMV visits, no lines, no phone mazes, and no appointments needed. Visit Quik, Click, Pay & Print your registration from home or any local print shop.

0 comments:

Post a Comment