Also contributing to this analysis: Andrew Balthrop and Ron Gordon.

Part 1 in this two-part series by three supply chain researchers features a review of potential trucking market impacts to flow from legislative changes that could require motor carriers to pay overtime to over-the-road employee drivers. Part 2 follows with safety effects analysis.

Part 1 in this two-part series by three supply chain researchers features a review of potential trucking market impacts to flow from legislative changes that could require motor carriers to pay overtime to over-the-road employee drivers. Part 2 follows with safety effects analysis.

Editor's note: The authors of the following series are faculty of the University of Arkansas and Texas Christian University focused on supply chain research and education. Click through their bylines above to find more about the authors.

The Fair Labor Standards Act of 1938 (FLSA) requires American employers to pay workers overtime when their workweeks exceed 40 hours. Trucking companies do not have to pay most employee drivers overtime because of the law’s motor carrier exemption -- but that will change if Congress follows through on the Department of Transportation’s recent advice. Bill H.R. 7517, introduced just a couple of weeks ago in the House, is the first attempt to do so.

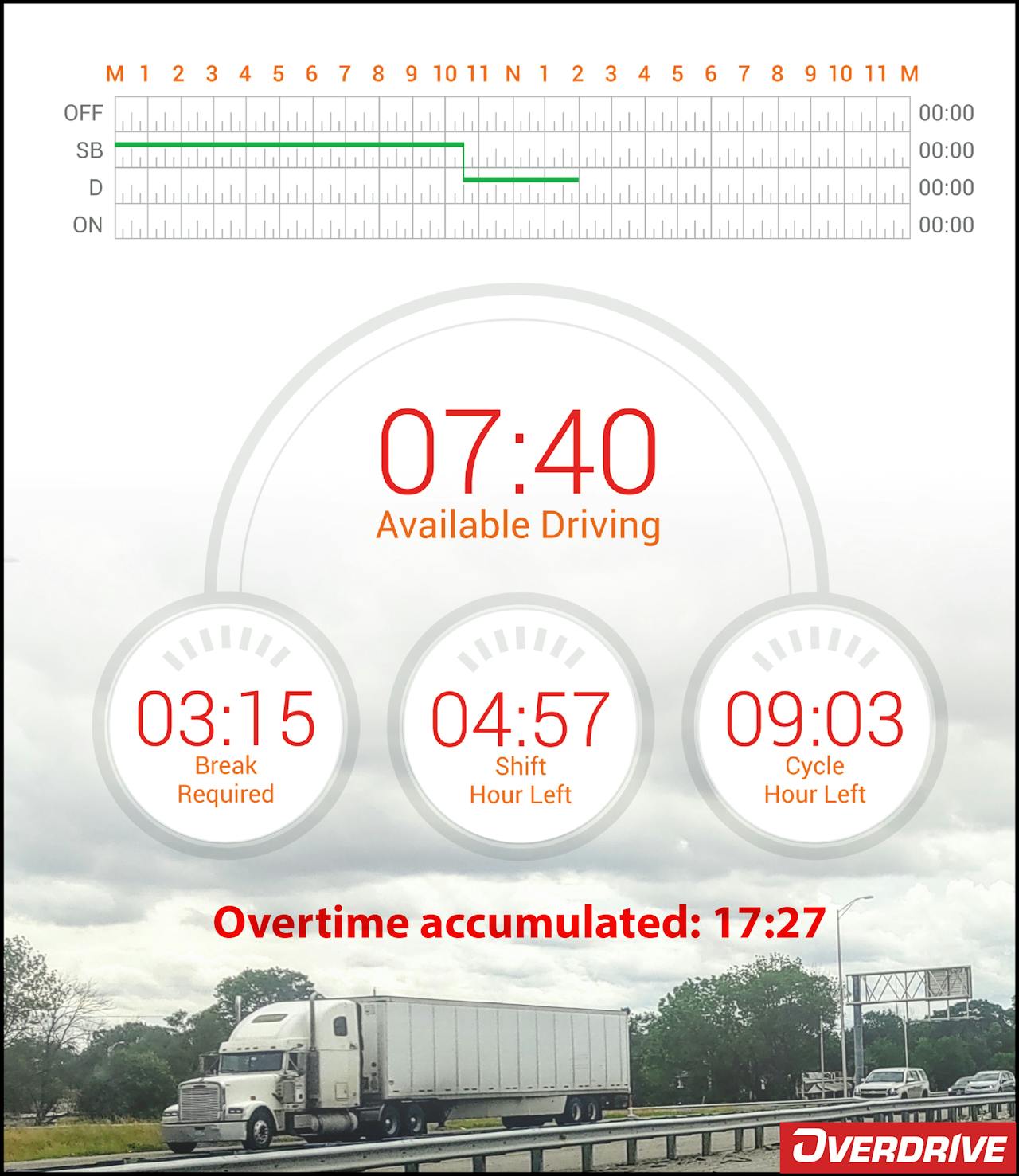

The DOT appears to support eliminating the motor carrier exemption as a way to “speed disaster recovery response,” presumably by increasing pressure on shippers and receivers to quickly load and unload trucks. Some contend that ending the exemption would also alleviate driver shortages by significantly raising drivers' wages. Others believe that the exemption -- which has sometimes been seen as improving trucking safety by disincentivizing drivers from working too many hours -- is outdated now that electronic logging devices track most drivers’ hours of service to the second.

This 2020 survey of drivers, conducted by the Owner-Operator Independent Drivers Association, found that 79% support the association’s efforts to end the exemption, so the move would be initially popular with many. But, like any regulatory change, it would likely have benefits, costs, and unknown unintended consequences. This article is the first of two examining how eliminating the motor carrier exemption may impact drivers and owner-operators, carriers, and the public. Part 1 here covers potential market effects, which could manifest in a range of possible impacts across the trucking industry.

It would almost certainly pose significant challenges for large carriers, but the extent to which it would impact owner-operators is much less clear. Most drivers would likely see some benefit, both financially and by spending less time waiting to load or unload shipments. And while the change could speed the automation of trucking and the elimination of certain jobs, it is unlikely to move the timeline forward enough to offset the short-term benefits drivers would enjoy.

[Related: Legislation to remove overtime-pay exemption for employee drivers follows DOT action item]

Carrier impacts would be felt directly

Ending the exemption would directly impact carriers who employ drivers much more significantly than independent one-truck carriers, though it is unclear how much company drivers would truly benefit. Carriers with company drivers could try to lower wages to offset overtime pay, keeping total earnings relatively unchanged. Or they may rely more heavily on independently-contracted owner-operators. Ending the exemption could reduce the number of company driving jobs, which offer stability, insurance, and retirement benefits that some prefer over the high-risk/high-reward business model of an owner-operator.

However, trucking’s longstanding hiring and retention woes could moderate efforts to reduce wages or replace company drivers with independent contractors.

Carriers who do not already pay company drivers overtime would also need to overhaul their systems for paying drivers and tracking their hours. While most employee drivers hauling over-the-road are paid per-mile, trucking has a hodgepodge of compensation models, including hourly wages, salaries, and percentage pay.

[Related: Percentage is king for leased owner-operators, long after the rise of miles post-deregulation]

Washington state, which does not recognize the FLSA’s motor carrier exemption, provides a formula that could be used to calculate overtime for drivers who are paid per mile. But carriers may find that some existing payment models or combinations of models are incompatible with overtime. Implementing new payment systems would require time and resources.

Single truck owner-operators leased to larger carriers would likely be unharmed by the change, at least in the short term. And though such owner-operators’ status as independent contractors would seemingly prevent them from receiving overtime pay as a direct result of the elimination of the exemption, they may indirectly benefit if large carriers pay company drivers more and freight rates rise as a result.

[Related: Is it overtime for company-driver overtime pay?]

Change could spur on automation

Though many company-employed drivers could benefit from the elimination of the motor carrier exemption in the near-term, it is possible that the change would hasten the automation of trucking.

Estimates vary on when automation will begin to displace drivers -- and some researchers believe media reports suggesting that automation will rapidly eliminate all driving jobs are badly misinformed. But it is clear that at least some trucking jobs will be automated in the not-too-distant future.

Autonomous truck technology has advanced rapidly in recent years, thanks partly to the support of large carriers. Several carriers have partnered with tech companies and manufacturers who are developing autonomous trucks. Labor already accounts for approximately 43% of the cost of trucking among companies employing drivers, so ending the motor carrier exemption may motivate large carriers to do even more to speed the development and deployment of autonomous trucks.

Efficiency impacts at shippers/receivers could be minimal

On the productivity front, many who favor ending the FLSA’s motor carrier exemption believe doing so will force shippers and receivers to become more efficient, thereby reducing the time drivers spend waiting at loading docks. Ending the exemption could make trucking more efficient and, by mitigating one of the major stressors drivers face, may help with driver retention.

Yet many carriers already pay drivers overtime and many charge hourly detention fees ranging from $25 to $100 and more when wait times exceed a contracted threshold, often two hours but sometimes a single hour. If existing driver overtime pay and detention penalties have not solved the problems, then adding more overtime pay to the mix may not make as big a difference as some expect when it comes to improvements in shipper/receiver efficiencies.

It is also possible that some drivers would be less inclined to pressure loading dock workers to hurry things along if they are receiving overtime pay while sitting at a warehouse. Indeed, some worry that introducing overtime pay will incentivize loafing across all elements of the job, which will increase lead times and reduce productivity, all while increasing operating costs. However, modern technologies such as electronic logging devices, GPS trackers, and driver-facing cameras would likely provide companies the tools needed to measure and monitor driver performance.

Read next: How would overtime pay affect trucking safety?

from Overdrive https://ift.tt/cK6FNAp

Sourced by Quik DMV - CADMV fleet registration services. Renew your registration online in only 10 minutes. No DMV visits, no lines, no phone mazes, and no appointments needed. Visit Quik, Click, Pay & Print your registration from home or any local print shop.

No comments:

Post a Comment