Record-high diesel prices have officially unseated the "driver shortage" narrative as the industry's No. 1 concern, according to the American Transportation Research Institute's (ATRI) 18th annual Top Industry Issues report.

The 2022 report, which was shared Saturday afternoon at the American Trucking Associations' Management Conference and Exhibition (MCE) in San Diego, and the survey on which it was based bosted 4,200 participants -- the largest response to date -- among carriers (39%), commercial drivers and owner-operators (47%) and other industry stakeholders (14%).

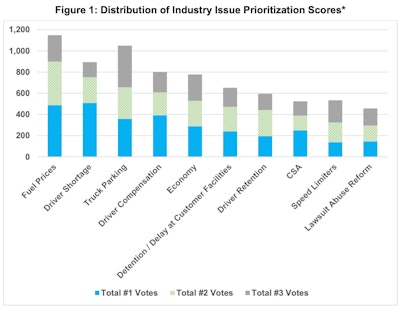

The results show that the so-called "driver shortage" dropped into second place overall after five consecutive years on top. This is the first time fuel has made the top 10 list in nine years after coming in at No. 8 in 2013. Interestingly, mandated use of speed limiters, a rule the FMCSA says it intends to propose next year, made a debut appearance on the list at No. 9.

ATRI's scoring methodology for the industry's top priorities lets respondents rank issues as first, second, and third priority. Historically, drivers and carriers see issues in trucking differently, so while neither group ranked fuel prices outright No. 1, it was the major area of agreement between the two groups.

Cargo Transporters President and CEO Dennis Dellinger said he isn’t surprised fuel prices topped this year’s overall list as many of the survey respondents were independent contractors or owner operators who have less ability to negotiate surcharges and bulk discounts, but larger carriers were affected too.

“From 2020 to 2021, we saw about a 15% increase (in fuel costs), and from 2021 to 2022 around a 63% increase,” the fleet exec said. “I think there’s a large disparity between smaller carriers and larger carriers when it comes to fuel. From the standpoint of a carrier, you have the ability to do a better job of purchasing bulk fuel … versus an independent contractor or owner operator. You have to run a good fuel surcharge program … and that’s something the independent or owner-operator can’t do" consistently when operating with authority and working spot freight with brokers.

At once, though, building a fuel surcharge into rates with shippers and even some brokers is certainly within the realm of possibility for an independent.

[Related: Trucking 101: Understand fuel surcharges]

Dellinger also noted the importance of "spec'ing your equipment for optimal fuel mileage,” something today's most successful owner-operators have found a way to afford.

The dramatic rise in fuel prices was the No. 2 and No. 3 concern for operators and motor carriers, respectively. The notion of a "driver shortage" remained the top concern among motor carriers, while truck parking took the top spot for operators.

Ultimately, ATRI compiles the list of industry priorities to direct research for the coming year, and as such the organization proposed the following strategies to combat fuel price inflation and volatility (ranked in order of popularity):

- Advocate for federal actions that help stabilize the supply of fuel and minimize price volatility.

- Research potential factors that may be affecting fuel availability and pricing volatility.

- Promote financial incentives for alternative and renewable fuels to support growth and reduce costs during development and market expansion.

Speed limiters, truck parking, detention and the economy

This is the first time speed limiters entered the overall Top 10 as the Federal Motor Carrier Safety Administration this year revived potential speed limiter implementation.

"Fuel prices coming on the list along with speed limiters pushed others that were in last year’s Top 10 out – diesel technician shortage, infrastructure, insurance cost/availability," she said.

The ATRI annual Top Industry Issues report was released Saturday. Shown above are panel-discussion participants (from left) Rebecca Brewster, ATRI president and COO; Idelic Chief Innovation Officer Hayden Cardiff; Dee Sova, America’s Road Team Captain and operator for Prime Inc.; and Cargo Transporters President & CEO Dennis Dellinger.

The ATRI annual Top Industry Issues report was released Saturday. Shown above are panel-discussion participants (from left) Rebecca Brewster, ATRI president and COO; Idelic Chief Innovation Officer Hayden Cardiff; Dee Sova, America’s Road Team Captain and operator for Prime Inc.; and Cargo Transporters President & CEO Dennis Dellinger.

While the U.S. Department of Transportation is funneling money – including recently announced $40 million in Florida and Tennessee – into increasing parking capacity, Dellinger said it’s still not enough.

“We need a lot more than the federal government. I think it has to start at the level of the state and local municipalities. They have to do better planning for development, ensuring that parking can accommodate the number of trucks that are going to be in and out of those industrial parks,” he said. “It’s going to take more than the money we’ve talked about allocating to this issue.”

Overdrive has been tracking a growing trend of local governments banning truck parking and detailed efforts operators can take to fight back.

[Related: How owner-ops can fight back in the war on truck parking]

Truck parking was at the top of the list for drivers, while it was at the bottom for carriers.

“That’s a large disparity in the two,” Dellinger said. “It makes me wonder, are we as trucking leaders out of touch with our drivers? Are we doing everything we need to be?” Similarly, detention/delay at customer facilities was high on operators' prioritization list at No. 3, while ranking No. 9 on carriers' list.

Worries over the wider economy rose from the No. 8 overall spot to No. 5. From skyrocketing inflation and severe parts and component shortages to wage pressures and record-high diesel fuel prices, truckers all around the business have had a tough year. The economy was given similar weight in both operators' (No. 6) and carriers' lists (No. 5).

[Related: Fleets, operators hugely at odds over truck parking crisis]

'Driver shortage' remains No. 1 carrier concern

The perennial fleet concern around recruiting issues sat at the No. 1 spot on the list for carriers this year, while "driver retention" sat at No. 2. "Driver compensation," absent from motor carriers' top 10 but at No. 3 for operators, of course plays a big role in retention.

ATRI President Rebecca Brewster said average starting bonuses were up 26% over the previous year, but retention bonuses were up 57%, according to ATRI’s annual Operational Costs of Trucking report. That shows, she said, that companies are acknowledging the need to better compensate operators.

"You’ve got to pay your drivers; they are the workforce that is building what you have,” said Dee Sova, America’s Road Team Captain, truck driver and driver-trainer at Prime Inc. “Just like you’re trying to build success in your entire company, these drivers need to be able to provide for their families. They need to be able to show a return on the efforts that they're putting out in terms of their time away from their friends or family; they’re giving up so much of their lives.”

[Related: Percentage pay is king for leased owner-operators, long after the rise of miles post-deregulation]

Lawsuits and the rising cost of insurance

Lawsuit abuse reform landed at the No. 10 spot on the list after insurance costs have risen 47% over the past 10 years, according to an ATRI study on insurance costs, Brewster said. Motor carriers' prioritization of it at No. 6 drove the ranking -- it didn't make the top 10 issues for operators.

There has been an increase in nuclear verdicts and lawsuits in general, and while Dellinger said his company will do everything it can to settle a case, it doesn’t always work out that way.

Hayden Cardiff, chief innovation officer at Idelic, which sponsored ATRI’s session, said it’s causing some trucking companies to have to shutter their doors.

“If you look at the industry as a whole, it would be so much more straightforward if we could defend cases on the merit of what actually happened with that driver, in that cab, in that instance, but plaintiffs attorneys are putting the fleet on trial,” he said. “We’re seeing it with large verdicts; we’re seeing it with small verdicts; it’s a consistent pattern where fleets are getting grilled for their hiring practices, their training and coaching practices, retention practices, instead of the actual facts of the case. That has always been the biggest challenge in law reform.”

Cardiff said what has helped the industry in combatting negative outcomes is moving away from individual one-off coaching to a more holistic approach, documenting and identifying driver behaviors as opposed to reacting to telematic events. Operationalizing safety, he said, builds a stronger culture that is much more defensible in court.

FMCSA safety program Complaince, Safety, Accountability (CSA) also made the overall top 10 again falling two spots to No. 8.

[Related: After the worst happens: How the nuclear-verdicts threat rolls downhill to small fleets, owner-ops]

from Overdrive https://ift.tt/OiLIshr

Sourced by Quik DMV - CADMV fleet registration services. Renew your registration online in only 10 minutes. No DMV visits, no lines, no phone mazes, and no appointments needed. Visit Quik, Click, Pay & Print your registration from home or any local print shop.

No comments:

Post a Comment