For established trucking owner-operators, and even those eyeing going into business for themselves for the first time, having good credit means a lot more than just a decent FICO score. Good credit in trucking is like good credit anywhere -- paying your bills on time, for a long time, builds a sturdy reputation, just like developing relationships with brokers and shippers would.

A recent poll of Overdrive readers shows that most in our audience don't have a problem with credit scores -- 58% reported a score above 750, and just less than a quarter at 700 or under, or unsure. (Credit scores typically range from 300 at the low end to around 850 for a near-spotless record.)

TopMark Funding, a truck financing company, wrote about a 2020 version of this Overdrive poll, and basically bashed it as unscientific (we never claimed we were). The group analyzed 2019 data on funded commercial vehicle financing transactions and found that the average credit score stood at 677. They also found "three times as many total applications below 677 than at or above 677." Those below 677 have a third the chance of actually finding funding anywhere than those above.

Among the total U.S. population, according to 2022 data published credit reporting bureau Experian, the average credit score in the U.S. sits at 714, up from 703 in 2019. Overdrive readers also reported generally higher credit scores since then, with bigger percentages in the 2023 polling indicating scores in higher ranges. Maybe some of that pandemic stimulus went to paying down old debt.

But credit history takes on a new importance in a landscape of rapidly rising interest rates, as has been the case for the last year. A higher credit score can mean a lower interest rate when searching for financing on a truck, a home or just about anything you'd finance.

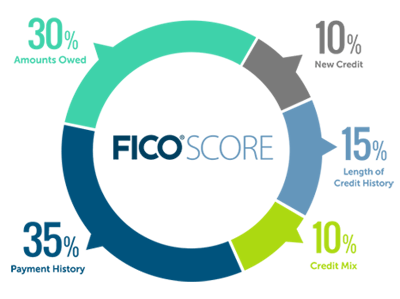

The FICO company's scores are derived from five areas of credit activity, which themselves are from records from the three major reporting bureaus. How they weigh each area is shown in the image here.

Plenty of paid services, including FICO's, promise to monitor or improve your credit score, and they can be helpful in quickly detecting identity fraud or other mistakes. Identity thieves can quickly tank your credit score, as has been well documented in the past, so this could be a worthwhile service.

[Related: Don't be a victim: How to guard both personal and business identity to prevent theft]

But some owner-ops describe the magic number as more of an afterthought.

Jeremy Corcoran, an owner-operator out of Colorado Springs, said he'd only ever worked on his credit score "in a roundabout way. ... I haven’t purchased any kind of anything to improve it. I pay my bills on time. I’m paying down my debt and my credit score is going up every month. Anything beyond that, like proactively trying to very specifically raise my credit score, I'm not doing."

In truth, while digging up old unpaid dentist bills and paying them might help shave interest points off a home loan, companies that finance trucks typically go a little above and beyond the credit bureaus' magic numbers.

Charles Smith, regional manager at Mission Financial Services, another truck financing outfit, said "we're not credit score-driven" when it comes to making loans. "We don’t even look at a credit score. We look at a credit profile summary and see the number of accounts, how many times they paid late. Is their mortgage current? Do they have any outstanding tax liens, do they owe the government child support?"

Truck loans are inherently high-risk, high-interest in some ways, according to ATBS President Todd Amen, perhaps one reason Mission might look beyond just a credit number.

[Related: With borrowing costs up, use financing relationships, experience to advantage]

"The way our loans are designed," said Smith, "the interest might not be a standard interest on a prime loan, but it gives you an opportunity to build equity in your unit."

Said Amen, "I think a lot of the fairly newer owner-operators got in the business in the last few years or today, and the industry has created mechanisms to make it fairly easy without great credit and without a lot of money" to lease or finance a truck. "There's a lot of risk as a lender, and many of those programs might be somewhat affected by higher interest rates. But they were built all along to take that risk, and to raise the interest rate probably won't make a big difference,."

Still, a bad credit score only reflects other credit problems that a lender would find via reports from the credit bureaus, whether or not they fuss over the FICO number.

Traditional funding outlets, like a bank or dealership, would probably be more likely to put weight on a credit score, said Amen. "I have heard lenders that have gone from a 630 FICO score minimum to 680, moved it 10%, to not take as much risk." The lower the score, he added, to greater the interest and/or the more money down required at loan origination for those lenders considering it prominently.

Jeffrey Dema, CEO of specialty truck financing/leasing company FoxPoint Trucks/OTR Leasing, said credit scores were "definitely an important component" of his own underwriting process, but ultimately he issues lease contracts on a "pass or fail" basis.

Having a solid credit score "gets drivers through the process quicker, and the trucks [we can] put them in at 650 [for a FICO score] are not the same type we'd put them in at 750," he added. "We're a little leery of higher priced trucks" in those low credit score situations, he said.

[Related: Cost of truck financing has rise, even as owner-operators show credit score improvement]

A few ways to improve your credit score

Some new and/or prospective owners may not have built up enough credit to show a good credit score. Pay for everything with cash? Rent and don't own your home? Your bill paying, in these cases, probably isn't moving the needle with regard to your score, so it might help to take out a credit card and get more solidly on the reporting bureaus' radar.

For most owner-ops, as polling indicates, that's not the case. If you have your own authority and bad credit, there's likely some past debt hanging over your head.

Experian, one of the three big credit reporting agencies (the others are Trans Union and Equifax), offers a handy guide on how to improve credit scores. They also offer an app that allows bills not traditionally counted in credit scores, like your cell phone or even your online streaming subscriptions, to be counted among other expenses, likely boosting your score.

Their advice essentially boils down to establishing and maintaining credit if you don't have it, paying down bills that might have gone to collections (there's a particular dentist that will never see a dime out of me, they know what they did), limiting the number of lines of credit you have and not applying for too many new credit cards.

If a lender thinks you're overleveraged with a huge mortgage to pay and a ton of debt, they'll be less likely to lend, whether or not they check the numbers.

Importantly, remember that lots of financing queries negatively impact credit scores. Shopping around for a home loan? Each new potential lender is likely to do what's called a "hard pull" of your credit data, which momentarily dings your credit just five points or so.

If you're asking around about lots of new loans and lines of credit, this will make a lender suspicious. Both Jeffrey Dema's FoxPoint Trucks/OTR Leasing and TopMark say they never do "hard pulls" of credit history, but ask potential lenders if they will.

Dema said if anyone has further questions, his company offers an "affordability calculator" to help plan around the decision to lease a truck. Ultimately, however, he added, the responsibility for paying debts is something most owner-operators are well aware of and used to.

[Related: Sharing the burden of a new truck payment]

from Overdrive https://ift.tt/ySV3CFA

Sourced by Quik DMV - CADMV fleet registration services. Renew your registration online in only 10 minutes. No DMV visits, no lines, no phone mazes, and no appointments needed. Visit Quik, Click, Pay & Print your registration from home or any local print shop.

No comments:

Post a Comment