A business plan, also known as a profit plan, is one of the most effective business tools you’ll use as an owner-operator. Think of it as a road map that allows you to track income and expenses over time, with the goal of reaching your desired financial rewards.

Though a business plan can take many forms, projecting short-range or longer-term business goals, at its most thorough a business plan helps you make ends meet. It shows you exactly how much money is needed for expenses, where it will be spent and how much you can afford to pay yourself.

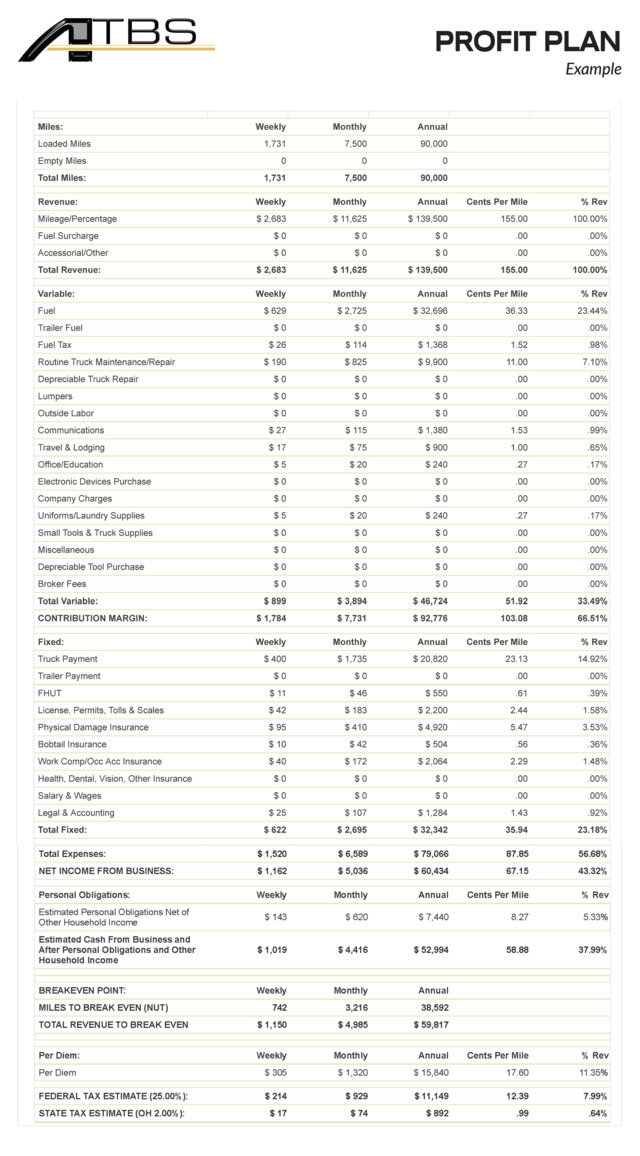

Your business plan should show all sources of income and costs while taking into account industry averages, personal expenses and cash flow. It also should provide this complete financial picture in weekly, monthly and annual detail.

It also allows you to know when you have reached your break-even point -- after which every extra mile driven puts more money in your pocket.

[Related: Don't let success overshadow the necessity of long- and short-range planning]

Getting started

The best time to begin the planning process is before you start your business. The process will give you targets, and these can be compared later with your actual financial performance to see where adjustments are needed to maximize profits.

In its simplest form, the business or profit plan should identify your revenue -- or gross income -- and your expenses. All personal household expenses should be included. While your books may reflect a profitable business operation, you may fall short of your personal needs and desires if household expenses are left out.

Be realistic

As you work through this process, gather as many of your collected invoices or settlement statements, bills and receipts as possible. Accumulate three to four months of expenses to reflect your spending habits properly. Don’t forget to budget for savings, estimated taxes, unexpected situations and lean times.

If you lack past data for developing your plan, be conservative in estimating your income, and slightly overestimate your expected expenses so you don’t start out with a flawed plan. If there is money left over, place it into savings for emergencies.

If you need help, a service provider like ATBS can estimate costs you may not be sure of. See an example from the owner-operator business services firm below.

Under this plan, the owner-operator runs 90,000 loaded miles, earning $60,434 on $139,500 in revenue, below more recent income averages around $63,000 annually.

Under this plan, the owner-operator runs 90,000 loaded miles, earning $60,434 on $139,500 in revenue, below more recent income averages around $63,000 annually.

[Related: How bad has owner-operator income loss been this cycle?]

Owners looking for additional business-planning and other management tips, among a myriad of other topics, can find more in the Overdrive/ATBS-coproduced "Partners in Business" manual for new and established owner-operators, a comprehensive guide to running a small trucking business. Click here to download the updated 2023 edition of the Partners in Business manual free of charge.

from Overdrive https://ift.tt/GzH7iTM

Sourced by Quik DMV - CADMV fleet registration services. Renew your registration online in only 10 minutes. No DMV visits, no lines, no phone mazes, and no appointments needed. Visit Quik, Click, Pay & Print your registration from home or any local print shop.

No comments:

Post a Comment