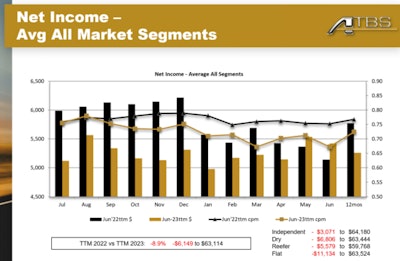

This chart from ATBS compared the July 2022-June 2023 time period to the prior TTM, or "trailing 12 months" (the bars showing monthly income, the lines income-per-mile, on the graph). Owner-operator income lost about 9% all told for the most recent 12 months, dropping to an average $63,114 annualized for ATBS clients. Losses were highest for leased flatbedders and dry van pullers, shown at the bottom right, with the broad category of independents losing the least.ATBS produced all charts in this story

This chart from ATBS compared the July 2022-June 2023 time period to the prior TTM, or "trailing 12 months" (the bars showing monthly income, the lines income-per-mile, on the graph). Owner-operator income lost about 9% all told for the most recent 12 months, dropping to an average $63,114 annualized for ATBS clients. Losses were highest for leased flatbedders and dry van pullers, shown at the bottom right, with the broad category of independents losing the least.ATBS produced all charts in this story

There are at least some signs business conditions could be beginning to improve after what's been an exceedingly difficult past year and a half for many owner-operators. That was the overall message of owner-operator business services firm ATBS Vice President Mike Hosted during Tuesday's mid-year benchmarking online session and market update. If not improving already, Hosted said, then at the very least "we’ve hit the bottom and we’re stable right now" when it comes to freight rates and overall volumes.

In addition to recent months' modestly improving monthly net income and income-per-mile measures, shown in the chart above, Hosted pointed to other indicators backing up his observations throughout the ATBS session. In spot rates and load-to-truck ratios in recent months he sees more volume coming into the market relative to the number of carriers operating there. "It's a good indicator the trucking market is balancing out," he said. "We should be stable with rates going forward, I think."

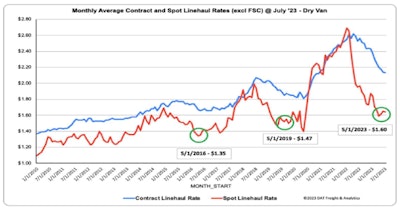

If that ends up being true, he added, the spot market seems to have made a bit of a correction to account for post-pandemic cost inflation. Among the many slides in his full presentation, Hosted shared the following chart showing two bottom points reached in prior cycles, in 2019-2020 and in mid-2016. Current lows, he believes, are unlikely to get lower, a "new floor," if you will, he said, higher than in prior cycles.

Circled here are spot-market-cycle bottom points in May 2016 ($1.35, excluding a fuel surcharge), May 2019 ($1.47) and May of this year, at $1.60. Since May, underlying rate weekly averages reported by DAT for dry van truckload in the spot market have tracked between $1.66 and $1.56.

Circled here are spot-market-cycle bottom points in May 2016 ($1.35, excluding a fuel surcharge), May 2019 ($1.47) and May of this year, at $1.60. Since May, underlying rate weekly averages reported by DAT for dry van truckload in the spot market have tracked between $1.66 and $1.56.

“I don’t know that we’ve ever seen freight demand fall this far so fast and for so long without an accompanying economic recession.” --Knight-Swift CEO David Jackson during a recent investor call. Hosted flagged the quote during his presentation though underscored his and others' view that the worst may be behind us.

As for the contract market, "we've been speaking with a lot of the major carriers out there," Hosted said. "Most of them say they’ve stopped negotiating lower rates" with shippers after losing plenty of their leverage throughout the downward cycle of the last year and a half. "They’re not going any lower, ... more evidence that we’ve hit the floor."

If history repeats itself, "and it usually does," Hosted added, "we're fairly far through the bottom process" period at the present moment. He guessed next spring might produce improved conditions overall in the market, though at least some others have suggested a slightly longer low.

"If you’re surviving now," Hosted added, "hold on. We should be getting better early next year."

[Related: Direct freight: Delivering a modicum of consistency in a turbulent market]

The bad news: Fuel's recent hikes could endure for some time

Inflationary costs aren't limited just to fuel, Hosted noted. Big truck repair bills have been among some of the biggest hurdles to improvement on the cost side. And in recent years, "it's the downtime that is the real killer" as fixed costs and home expenses just keep rolling in. "That really inflates the true cost of a repair bill."

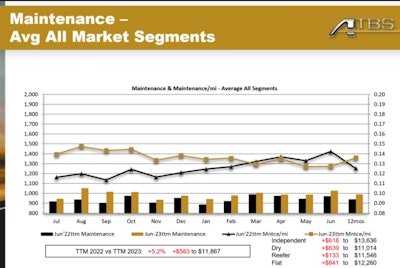

The toxic cocktail of a major mechanical failure and all those associated costs are perennially among the top two causes of owner-operator business failure out there, and inflation has continued to raise the price of maintenance through much of the last year.

Maintenance costs, year over year comparing these two July-June periods, are up 5% on the whole, with the average owner-operator spending roughly $12,000 annually on maintenance.

Maintenance costs, year over year comparing these two July-June periods, are up 5% on the whole, with the average owner-operator spending roughly $12,000 annually on maintenance.

Yet "look at the trendline," Hosted urged. "We peaked last year at 15 cents/mile" for maintenance costs. With real costs moderating and owner-operators now running more miles to make up for revenue losses with falling rates, maintenance is sitting at 13 cents/mile and has fallen on a per-mile basis throughout the most recent July-June period.

The current fuel situation is hampered by Russia and Saudi Arabia cutting oil production to prop up pricing worldwide, Hosted said, unfortunately, as CCJ Editor Jason Cannon also recently reported. You can't control world oil-market dynamics, but truthfully "fuel is your most controllable cost," according to Hosted.

Catch Mike Hosted's presentation in more complete form via next week's edition of the Overdrive Radio podcast. Subscribe to the podcast on your listening platform of choice for early access to the series -- the podcast drops typically every Friday to the feed and follows here at OverdriveOnline.com and in Overdrive's Youtube and Facebook feeds the following week. You can subscribe for first access via Apple and Google podcasts, Spotify, TuneIn, most anywhere you listen.

Catch Mike Hosted's presentation in more complete form via next week's edition of the Overdrive Radio podcast. Subscribe to the podcast on your listening platform of choice for early access to the series -- the podcast drops typically every Friday to the feed and follows here at OverdriveOnline.com and in Overdrive's Youtube and Facebook feeds the following week. You can subscribe for first access via Apple and Google podcasts, Spotify, TuneIn, most anywhere you listen.

Fuel mileage has taken a hit since the salad days of the early part of the COVID pandemic, when averages skyrocketed among ATBS clients with the huge fall-off in highway congestion. Rates were so good in the aftermath, too, mpg improvement took a backseat to focus on running up revenue. "Now that rates have gone down," Hosted said, "we are seeing the reaction" among clients -- not only more miles, but better fuel mileage.

The best owners out there are doing both, everything they can to boost efficiency. "Most economists think [higher fuel prices] will continue through the election cycle" next year, Hosted said, speculating $5/gallon as a possible national average in the shorter term. If you're getting a fuel surcharge with customers/carriers, as long as you're exceeding the fuel-mileage average on which the surcharge is based, you'll make more money the higher the price goes, ultimately.

On the whole, analyzing the two July-June periods against each other, fixed costs were up 5% to an average 60 cents a mile. Variable costs hit 70 cents a mile.

Truck payments have steadily risen over the long term, yet pricing in the used market, Hosted said, is down 25% year over year after astronomical COVID-era highs. That's one among other "really encouraging" though far from perfect signs the outlook could well be more positive than negative for owner-operators who continue to weather this storm.

[Related: Trucking 101: Understanding fuel surcharges]

from Overdrive https://ift.tt/beAQahu

Sourced by Quik DMV - CADMV fleet registration services. Renew your registration online in only 10 minutes. No DMV visits, no lines, no phone mazes, and no appointments needed. Visit Quik, Click, Pay & Print your registration from home or any local print shop.

No comments:

Post a Comment