As California and states that adopt its emissions regulations continue to forge ahead toward the elimination -- or drastic reduction at the very least -- of diesel engines, fleets and certain owner-operators are left to figure out how to meet the requirements.

With overlapping rules that apply to manufacturers and end users each, they can be particularly hard to parse. When it comes to potential investment in a "zero emissions" truck (ZEV) to meet those rules, furthermore, similar dynamics make for a confusing landscape for funding.

The California Air Resources Board’s Advanced Clean Trucks rule, mostly aimed at equipment manufacturers, requires OEMs to sell ZEV trucks at an increasing percentage of their annual California sales from 2024 to 2035. By 2035, ZEV truck/chassis sales would need to be 55% of Class 2b-3 truck sales, 75% of Class 4-8 straight truck sales, and 40% of truck-tractor sales.

In March, CARB received a waiver from the Environmental Protection Agency, allowing other states to adopt the rule. (With California being the only state in the union allowed to make its own emissions regulations, Section 177 of the Clean Air Act allows for those states to adopt California’s standards instead of federal regs.) With the ACT, nine other states have taken California's lead: Colorado, Maryland, Massachusetts, New Jersey, New Mexico, New York, Oregon, Vermont and Washington.

The ACT rule also includes reporting requirements for fleets with more than 50 trucks, which CARB said will help identify future strategies to ensure that fleets purchase available zero-emission trucks and place them in service where suitable to meet their needs.

On top of the ACT, CARB finalized in April its Advanced Clean Fleets rule, requiring all new medium- and heavy-duty vehicles sold or registered in the state to be ZEVs by 2036. The ACF requires all trucks in use in the state to be ZEVs by 2042. As reported in previous parts of this series, the ACF rule kicks in first next month for drayage operators, regardless of fleet size, and requires trucks to be registered in CARB’s Truck Regulation Upload, Compliance, and Reporting System (TRUCRS) to conduct port and intermodal activities in California. Legacy diesel trucks operating at ports and railyards must register in the system before the first of January to continue operating.

After Jan. 1, any new trucks registered in the system for dray work must be ZEVs, according to the rule, though legal action is pending against both the ACF and ACT, and the ACF has not received an EPA waiver under the Clean Air Act.

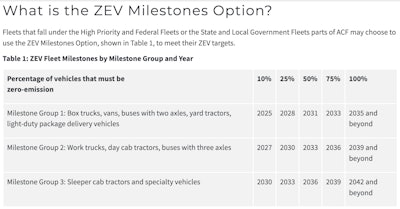

Under the ACF, so-called "High Priority" fleets -- with 50 or more trucks or with $50 million or more in annual revenue -- will be required to fully transition to ZEVs by 2039 for fleets of work trucks and daycabs, 2042 for sleeper tractors.

[Related: California banning diesel truck sales in 2036]

So small fleets and owner-operators, unless in drayage, don’t have to worry about it, right? Well, not quite.

Niki Okuk, deputy director at Calstart, said she has heard and seen bigger customers, such as shippers and larger fleets, looking for small fleets with ZEV equipment to help them meet their own sustainability goals.

“Small fleets shouldn’t feel like they have to [transition to ZEVs] right away, because it is a big cost,” Okuk said. “But there are a few things to keep in mind. Customers, larger carriers who are looking for smaller businesses to run lanes, they have an obligation to meet. If you can help them with that obligation, then making a zero-emission investment can pay off in developing long-term relationships with customers.”

The CARB-funded Sustainable Fleets Accreditation Program helps those bigger companies find smaller fleets “that are going to represent their company’s commitment to emissions reductions,” she added.

As Okuk mentioned, there is a big cost in transitioning to a zero-emission truck, whether that is a battery-electric or hydrogen fuel cell-powered unit. She noted costs of a truck can range from upwards of $350,000 to more than $400,000 -- more than double the price of a new diesel-powered truck today in many cases.

[Related: California becomes first government in the world to mandate electric trucks]

The challenge for federal funding, tax credits available

Fleets large and small can find help in covering the higher up-front cost of those units, however.

At the federal level, the Commercial Clean Vehicle Credit allows businesses that buy an electric or fuel-cell vehicle with a gross vehicle weight rating over 14,000 pounds to qualify for a $40,000 tax credit. That program took effect this year, so any business who bought a qualifying truck in 2023 can claim that tax credit in 2024 when 2023 taxes are filed. That program will be around for 10 years.

Bri Lawrence, vice president of programs with clean transportation and energy consulting firm GNA, noted that with state-level funding, however, there can be a number of hurdles for small fleets in particular.

One of those hurdles is a scrappage requirement that's part of many incentive programs, requiring any fleet to get rid of a diesel truck in order to receive funding toward the purchase of a ZEV.

“A small fleet usually can’t afford to have a vehicle go down, and they’re not typically carrying any spares,” Lawrence said. “To turn in a diesel truck for another that they don’t know that well, the range is more limited, maintenance is an unknown and downtime is an unknown. ..."

That's a scary proposition, she added. "That scrappage requirement can be an immediate hurdle.”

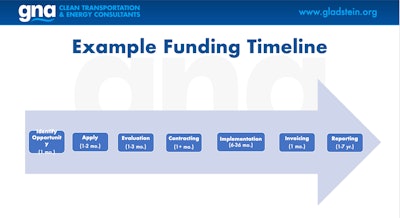

GNA's Lawrence said fleets need to be aware that, if they plan to apply for funding to buy an electric truck, it's not usually a quick process.GNA

GNA's Lawrence said fleets need to be aware that, if they plan to apply for funding to buy an electric truck, it's not usually a quick process.GNA

At once, she said, a benefit of programs with scrappage requirements is that funding levels are often higher, because the fleet is getting rid of a higher-polluting vehicle.

The Diesel Emissions Reduction Act has such a requirement in its federal scheme to administer money through the states. DERA funding can cover up to 45% of a zero-emission vehicle, Lawrence noted.

Funding is also available through the Volkswagen Diesel Emissions Mitigation Trust at the state level, though some states have already allocated all of their funding, and it also has a baked-in scrappage requirement, Lawrence said. In states with VW trust funding still available, fleets can request up to 75% of the cost of an electric truck.

Lawrence noted, however, that there are state-level programs that are more flexible when it comes to scrappage, as each state can determine how to administer their own funding.

Another challenge, particularly for small fleets, is that many are leasing a parking space or location for their equipment, which makes getting funding for charging infrastructure more difficult. Some incentive programs for chargers require the beneficiary use the infrastructure for 10 or more years, which means the fleet or owner-operator would have to bring their landlord into the equation. (Read more on charging infrastructure funding incentives below.)

“If you’re leasing a parking spot, how do you make a funding agency comfortable without a 10-year lease?” Lawrence said. “Maybe your landlord sees the value of chargers, but that adds an unknown element.”

Another problem fleets could run into is the lack of someone on staff who knows how to write grants to secure funding. There are resources that fleets can leverage for that, including the Clean Cities Coalition Network, which Lawrence said is well versed in what opportunities are available. “Reach out to your local coalition and let them know you’re interested in learning about incentives,” she said.

Firms like GNA and Calstart are also available to help guide fleets in the right direction.

[Related: With CARB ZEV deadline looming, port dray haulers turn to battery electric trucks]

Big money in California, less in other states

Whether you’re a large or small fleet, there are numerous incentive programs currently in California to help soften the blow of transitioning to a ZEV hauler.

Lawrence said the key program to look into is the Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project (HVIP). Under HVIP, qualifying Class 8 trucks are eligible for a $120,000 voucher.

Small fleets with fewer than 20 trucks and less than $15 million in annual revenue can qualify for HVIP’s Innovative Small e-Fleet (ISEF) voucher, which doubles the Class 8 voucher to $240,000 -- plus, there’s no scrappage requirement. Additionally, if you’re buying the truck for drayage operations, you can add another 25% on top of that voucher, plus another 15% if you’re domiciled in a disadvantaged community.

Combining all of those incentives, Okuk said, then adding in taxes, likely puts a buyer at or below what they would pay for a new diesel truck today.

Another statewide program in California that Lawrence noted is friendlier for small fleets is the Carl Moyer program. While it does require scrappage, a small fleet can request 80% of the cost of a zero-emission truck. It can also be combined with HVIP funding, she said, but it’s worth noting that you can’t get more funding than what a project costs so that a fleet isn’t “making money” on a ZEV purchase.

Though California may be the big player in the game as far as incentives, nearly all states have some funding available. The Department of Energy has compiled all federal and state incentives into one resource -- its Alternative Fuels Data Center. While it’s a “great resource” for fleets, Lawrence noted it does “take more digging” to find incentives you qualify for and that meet your needs.

Okuk said EPA’s SmartWay program site also offers resources for heavy-duty truck electrification, including grants and incentives, total-cost-of-ownership calculators and more.

CARB and Calstart this summer also launched the free Cal Fleet Advisor program, intended to provide personalized guidance in understanding and meeting the requirements, including getting information about funding and other assistance that will be made available.

[Related: California 'not' dreaming: CARB year-end deadlines getting real for truckers]

Infrastructure funding

Another potentially large cost associated with transitioning to electric trucks is the charging infrastructure.

Small fleets may try to rely on public infrastructure, but at least right now, there aren’t enough public chargers to meet electrification goals. Lawren Markle, GNA’s senior manager of communications strategy, said initiatives are underway at California ports worth millions of dollars, but it still won’t be enough to charge all the trucks in drayage operations. It doesn’t help that those large projects take 18-plus months, he added, putting charging infrastructure even further behind vehicle deployment.

Lawrence said investor-owned utilities (IOUs) in California and utilities across the country are offering incentives for fleets to install chargers on their property. Many utilities are also offering charging rebates and other incentives to help with the cost of electricity.

Okuk and Lawrence noted that, in addition to the utilities, the California Energy Commission also has funding available for charging infrastructure through its EnergIIZE Commercial Vehicles (Energy Infrastructure Incentives for Zero- Emission Commercial Vehicles) program.

All of the reports in this series surveying the regulatory, business and infrastructure landscape around new electric-drive equipment:

**Attitudes, performance: Tesla's Semi blows past diesels uphill, but do owner-ops care?

**Early adopter: Hight Logistics: Among small fleets, definitely 'one of the first' proving out battery-electric in drayage

**Charging/fuel infrastructure: Electric trucks don't stand a chance, even in drayage, without more infrastructure

**Early regulatory requirements: With CARB ZEV deadline looming, port dray haulers turn to battery electrics

**Equipment market: Known unknown: How the used market will develop for Class 8 electric trucks

**Incentives/funding: Electric-truck purchase incentives present small-fleet challenges

from Overdrive https://ift.tt/s64AyXu

Sourced by Quik DMV - CADMV fleet registration services. Renew your registration online in only 10 minutes. No DMV visits, no lines, no phone mazes, and no appointments needed. Visit Quik, Click, Pay & Print your registration from home or any local print shop.

No comments:

Post a Comment