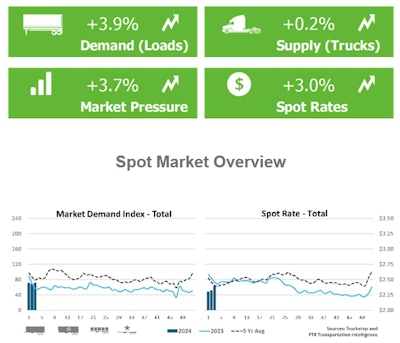

Tough winter weather across the nation delivered a spot-rates increase to owner-operators and small fleets last week, with FTR Transportation Intelligence and the Truckstop load board network reporting a 3% rise overall with mixed pictures in the major dry van, flatbed and refrigerated segments. Rates for all three, however, heated up by varying degrees as temps plummeted.

Find Truckstop and FTR's full market commentary for the week via this link.

Find Truckstop and FTR's full market commentary for the week via this link.

DAT Freight & Analytics saw similar dynamics, attributing the boost to shippers scrambling to move loads and contract carriers hampered by weather, necessitating a turn to brokers and owner-operators on the spot market. If the boost in spot volumes persists through this week, it could further narrow the spread between spot and contract rates averages, a signal some watchers feel shows the market turning.

Last week, DAT's monthly Truckload Volume Index illustrated the contract/spot spread for vans had narrowed again in December to 39 cents overall, with spot rates continuing to lag below the average contract move, as they have for well more than a year now. A convergence of spot and contract rates, DAT reported, would signal an end to the current cycle of falling prices for truckload services.

Averaged over the month of December, “at 39 cents, the spread between spot and contract van rates is still substantial but was down 7 cents compared to November,” said DAT Chief of Analytics Ken Adamo. Prices to move van freight rate under contract hit the lowest average in three years, he added, and spot rates gained, adding three cents. Entering 2024, while shippers were still "in a strong position as they negotiate contract rates," carriers on the spot market would be justified to "have some optimism that the market will turn.”

[Related: Trucking conditions: A big improvement in late Fall, but 2024 outlook bleak]

Negative contract pressures remain highHenderson, Kentucky-based Silver Creek Transportation's Jason Cowan, 2021 winner of Overdrive's Small Fleet Champ award, has seen the downward pressure on contract rates over the last year, he said, with big brokers and low-cost carriers underbidding his company in some instances with direct customers. "We’re glad we diversified so that we can duck the bad market," he said. To an extent, that is. "It’s my experience that 'Hey, I give great service and we’re always there on-time' only goes so far [with customers] when the market dips" as far as it has. Customers will eventually "take a chance on somebody else who will do it cheaper."

Silver Creek has focused on "taking care of the customers who are willing to pay for the service," generally speaking, he said, adding "there's no magic bullet out there. I'm sad for my friends who haven't made it through" the tough times, including many owner-operators in his area.

Bigger companies, too, have failed. He pointed to the Chapter 11 bankruptcy filing of nearby, and much larger than 35-truck Silver Creek, Elmer Buchta Trucking, likewise two others nearby who bailed out the market at different points in 2023 as low spot rates drew the contract market down with them.

Meantime, Cowan got to calculating and running the numbers on a new contract opportunity to "reinvest and hope for the best," he said. "We bought 26 walking floor trailers" to add to a stable of, variously, tankers, flatbeds and vans and "got into the recycling business" hauling paper for that customer. "Those kind of things have helped us to stay healthy -- anything that you can do that nobody else can" to set yourself apart.

Hopefully for independent owner-operators and small fleets in the spot market, last week's weather explosion helps, at least short-term. So far in January, according to DAT's Trendlines metrics for the week, the contract/spot spread for vans has narrowed another nickel.

[Related: Truckers' New Year's Resolutions: Get closer to the freight source, and back to basics on costs]

Here's average spot rates all-in, from FTR's most-recent-week analysis of Truckstop load board data, over the course of the last year.

Rates all-in, Truckstop and FTR reported, were at their highest level since the end of June 2023, though still 2.5% below the same January week in 2023. That year-over-year deficit, though, was the smallest since July 2022.

DAT's look at underlying linehaul rates, calculated by subtracting an average fuel surcharge (44 cents for vans, 49 for reefers, flats 52), showed similar dynamics, with reefers benefiting from demand for temp-control equipment to keep goods from freezing in some cases, no doubt.

[Related: How to not just survive, but thrive, through the bottom of the freight markets]

from Overdrive https://ift.tt/2qcL7rb

Sourced by Quik DMV - CADMV fleet registration services. Renew your registration online in only 10 minutes. No DMV visits, no lines, no phone mazes, and no appointments needed. Visit Quik, Click, Pay & Print your registration from home or any local print shop.

No comments:

Post a Comment