That was the headline in April 2022, with fuel prices spiking to previously unseen highs and spot rates pulling back as the pandemic "sugar high" began to wear off. The headache was setting in.

A year later, the bloodbath label remains subjective, but we are getting some hard data. Owner-operator income in 2022 took a hit, nearly 10% across the board in fact, looking at the averages of ATBS clientele. Leased flatbed haulers saw the worst category drop in ATBS's accounting, with nearly $16,000 in income gone on average gone to 2021, and leased dry van and reefer haulers gave up about $5,000. Independents across trailer segments dropped about $7,000 on average.

Some of that lost income owes to fewer miles driven, but the rest traces back to the one-two punch of soaring costs like diesel and repairs, and sinking rates. Fuel's wild ride over the last year played a big part for many, well evident in the chart below showing the highest of highs last summer and this year's slight declines, at least through mid-February.

Asked about the drops in owner-operator income, independent owner-operator Patrick Mashburn didn't blink. He suggested he'd seen declines "double or triple" as bad as the reported averages. Mashburn, who owns both a step deck and a reefer, said he made a lot of money in 2021 but is struggling to make ends meet a year into the worst fuel crunch on record.

"This year, I don't know if these brokers are thinking reefers run on air, but I'm seeing them set reefer rates like they're dry van rates," he said. "I've even seen dry van rates better than reefer rates. They want you to take a frozen load for $1.20 a mile."

On paper, Mashburn is doing a lot right. He's getting a good fuel discount with the fuel card from the National Association of Small Trucking Companies, doing his best to build relationships with brokers like C.H. Robinson, Coyote and J.B. Hunt, among others, and staying on top of "quite a few" load boards, including those of DAT, Truckstop, and Trucker Tools.

But, in practice, he's a few months from having to lease on with someone, he added, if nothing changes or things get worse. Mashburn isn't alone, and his troubles are shared by untold thousands. A closer look at the economic picture might not offer many hope, but there are certainly counterexamples that could suggest a way forward through maximum efficiency and excellence in customer management and specialization.

[Related: Small fleet owner leads boycott of TQL]

The gory details: Freight recession hitting its low point?

The last monthly jobs report showed trucking employment, a measure of company drivers, down 9,000 jobs in February, one of the worst single-month dips since the dawn of the pandemic. Last week, two large banks all but collapsed under the weight of rising interest rates and a souring economy. Even though diesel prices have gone down about $1.50/gallon since their peak in June 2022, they remain high, as do lots of other prices, all of it a threat to otherwise successful owner-operators. On Tuesday, the latest consumer price index report showed menu prices for food in restaurants up 8.4% year-over-year and shelter prices, like rent, up 8.1% over the same period.

The latest read on spot rates from FTR Transportation Intelligence suggests that rates may have bottomed out and returned to a kind of "normal" after the salad days of 2021. Still "2023 looks rather ugly," said FTR VP Avery Vise. DAT's latest monthly numbers showed February load-to-truck ratios hitting their lowest points since May 2020. Rates fell 14 cents that month for dry van, 19 cents for reefer, and six cents for flatbeds. Since then, averages have continued to fall of for vans and reefers.

Vise said there's no sign of rates ticking a large amount further down, or up, but that the contrast over the last few years is incredibly stark. FTR did an analysis starting in November 2021 and compared that to dates in March, June, and December of 2022.

"What we found was quite dramatic," Vise said. "A one truck dry van operation after expenses should have been clearing six figures before taxes, but by the time we got to December [of 2022], with the increase in diesel costs, that number had dropped to below $40,000," said Vise.

Vise admits those numbers are based on "probably flawed cost assumptions," but still, he contended, it wouldn't be totally out of the realm of possibility to see a one-truck operation go from "$98,000 to $38,000 a year" given dramatic upward cost and downward rate pressures.

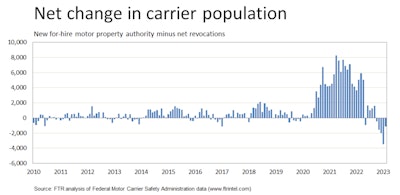

Is this the trucking bloodbath? Carrier population sees a major reversal after an unprecedented surge in the early pandemic.

Is this the trucking bloodbath? Carrier population sees a major reversal after an unprecedented surge in the early pandemic.

As for the record number of new authorities granted throughout the pandemic period (shown above), Vise said he's seen authority revocations outpace new ones for the last five months. "We haven't had five straight months of decline since the Great Recession," said Vise.

Additionally, owner-ops who bought equipment three years ago at the dawn of the pandemic might now need to replace the used equipment, and they'll do so in an environment where prices (finally) are coming down, yet interest rates are way up. Parts sourcing and labor rates for repairs, for those owner-ops trying to maintain older equipment, have also surged.

[Related: Owner-operators navigate rocky parts-procurement landscape]

How some fight, and beat, trucking's downturn

Despite facing dire straits, some owners have come through what looks like the worst of trucking's headwinds with a strong grip on their finances and a laser focus on the bottom line -- to success in profit.

Overdrive's 2022 3-10-truck division Small Fleet Champ Chris Porricelli, owner of CAP Trucking, managed to survive, even thrive by zeroing in on a profitable niche: LTL reefer. Porricelli has family ties to owners of a longstanding Hunt's Point Market produce business in New York City, and made connections in his new home in Florida to carve out a lucrative business that mostly occurs away from the dog-eat-dog spot market.

His key to success in hard times? "Consistency," said Porricelli. "When people don’t want to buy as much, they buy less, and when they buy less, they're not getting a full truckload anymore," he said. "LTL is one of those things where the per-pallet rate is increased just enough so you can justify making the extra pickup stop, and the customer is still saving money not paying for a whole truckload."

Chris Porricelli, pictured with one among his company's rigs, a 2003 Peterbilt 379, and his wife, Lauren.

Chris Porricelli, pictured with one among his company's rigs, a 2003 Peterbilt 379, and his wife, Lauren.

Porricelli's business model perfectly fits with "middle-sized businesses that don't want full loads but need items in consistent measures," he said, and the LTL model allows him a lot of flexibility when customers need more, or less, product.

"I use the load boards probably for about 15%-20% of my business, tops," he said. "I call that filler freight. It's just whatever I need to fill out the trucks" and make north-south runs profitable.

As far as financial discipline goes, Porricelli makes a point to not use freight factoring services. "I just try to balance out the difference between resolving a small credit card balance versus losing 3% for a quick pay option," he said. "I don't always carry a credit card balance, so sometimes I'm better off just holding it. Quick pay on a few million a year in loads adds up to a very large number."

Financial discipline doesn't just extend to waiting for checks to clear, invoices to be paid -- he was naturally suspicious of the excesses of the pandemic boom economy.

"'What goes up must go down.'" he noted. "Things have been so inflated for so long, it's kinda like a comedy skit. 'Wow, that truck really sold for $300,000,' or 'that trailer really sold for $200,000,' -- that’s not a good thing. We shouldn't be bragging about it and supporting it. That's a serious problem."

Overdrive's January Trucker of The Month, Kelvin Schmidt, admits to being "as bad as an accountant" when it comes to financial discipline, so no quick pay or factoring for him, either. But unlike Mashburn and Porricelli, Schmidt doesn't own a glider, and uses his advantages in fuel efficiency to beat out the competition.

"I drive a 2024 Volvo VNL 860 that's set up for fuel mileage," he said. "I want the most fuel-efficient setup I can get." He just recently took delivery of the unit, and "when it’s all broke in I expect 9.5-10 mpg, and I put the two biggest fuel tanks I can put on it."

With two 150-gallon tanks, Schmidt can haul clear from his home base in Minnesota to New York and back and only fill up in Wisconsin, where his fuel card gets his per-gallon price down to about $3.50 lately. Of course, he's careful to keep a close eye on the real price of fuel, ignoring the state taxes that all come out in the IFTA wash anyway. Schmidt constantly takes pen to paper to figure out his exact cost per mile while on the road, and religiously defends that number.

[Related: 'What's this $400 fuel tax bill from Pennsylvania?' IFTA primer for owner-operators]

"Don't haul cheap freight," he said. "You got to have working capital, you got to have a slush fund" for rough times.

Kelvin Schmidt's brand-new 2024 Volvo VNL, pictured the morning it was delivered.

Kelvin Schmidt's brand-new 2024 Volvo VNL, pictured the morning it was delivered.

Schmidt's strategy relies less on a specific niche, like Porricelli's, and more on intensely controlling costs and spending, which he finds easiest with a brand-new truck with a predictable payment. Schmidt looks to replace the equipment every few years, only running while under warranty and depreciating the $210,000 truck up to $70,000 a year, saving a bundle on taxes in the meantime.

Schmidt admits the old long hoods "look badass," but that he "doesn't give a" hoot about his truck other than as a tool for profit to support the family. "I rinse it off, but I don't even polish it. I have two artificial knees, I have six kids at home and a wife, I support my whole family. I don't want my wife to have to work."

Kelvin Schmidt driving his previous late-model Volvo before trading it in for a newer one. Schmidt says he paid $9,000 for a factory APU from Volvo, never runs any equipment out of warranty, and sleeps soundly knowing he's fully CARB-compliant and legal in California, a frequent destination.

Kelvin Schmidt driving his previous late-model Volvo before trading it in for a newer one. Schmidt says he paid $9,000 for a factory APU from Volvo, never runs any equipment out of warranty, and sleeps soundly knowing he's fully CARB-compliant and legal in California, a frequent destination.

Last year, looking ahead to the likelihood of a downturn in trucking, owner-operator Joe Bielucki suggested "the strong" would survive. In that story, other owners noted they make the most money when fuel goes high, as surcharges balloon and high costs force the inefficient others out of the business.

Porricelli found strength in his relationships and network to build a profitable niche, while Schmidt found strength in his family that kept his razor-sharp eye on costs.

Whatever the state of your operation right now as trucking hits a low point, look to that strength as a way forward. If Vise and others are right, things might only go up from here.

from Overdrive https://ift.tt/GjOfgQu

Sourced by Quik DMV - CADMV fleet registration services. Renew your registration online in only 10 minutes. No DMV visits, no lines, no phone mazes, and no appointments needed. Visit Quik, Click, Pay & Print your registration from home or any local print shop.

0 comments:

Post a Comment